Gold a darling investment not just for Indian households! Why corporates are investing big in gold ETFs – explained

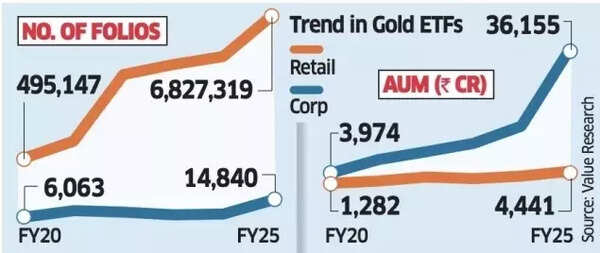

Gold has always found traction as a safe haven asset in Indian households. But, you may be surprised to know that corporates are also investing in a big way in the precious metal – albeit its paper version, the gold ETFs.During a five-year period when gold prices increased by 86% in dollar terms per troy ounce, corporate assets under management (AUM) in gold ETFs experienced substantial growth at 55% annually, reaching ₹36,154.5 crore by March 2025, according to Value Research data quoted in an ET report.

Why Corporates Are Betting on Gold ETFs

- Corporate entities, including companies, family offices, trusts and organisations, have increased their involvement in gold investments, particularly due to the unprecedented surge in gold prices over the past year.

- Corporates proportion of total

Gold ETF AUM has risen to an unprecedented 61.4%—up from 50% in March 2020. - In contrast, individual investors’ share in the AUM decreased significantly—falling to 7.5% in 2025 from 16.1% in 2020.

- Nevertheless, retail folios increased by 37% year-on-year in 2025 to approximately 6.8 million, while their AUM grew by 39% to ₹4,440 crore during a year that saw the largest price increase for the secure asset due to global institutional purchasing.

- Traditionally, corporate investors have favoured the money market and liquid funds because of their high liquidity and minimal risk profile. These liquid funds, which come without entry or exit charges, enable straightforward cash management. However, these investors are now considering gold ETFs to diversify their investment portfolios, appreciating the convenience of holding gold in electronic form.

- “They (institutions) are now more actively allocating to gold as part of diversified strategies aimed at managing risk and preserving capital,” said Vikram Dhawan, Head of Commodities and Fund Manager at Nippon India Mutual Fund. “This shift reflects growing institutional confidence in Gold ETFs as an efficient and transparent vehicle for accessing bullion exposure within a regulated framework,” the financial daily quoted him as saying.

Huge Rise in Gold Prices

Gold prices surpassed ₹1 lakh per 10 grams in June 2025, primarily due to investors seeking safety during global political unrest. By March-end this year, 24-carat gold reached ₹89,000 per 10 grams, showing a significant increase of nearly 30% from ₹69,000 in the previous year.

Gold ETFs

The total gold ETF Assets Under Management (AUM) includes retail investments made through Fund of Fund (FoF) schemes, which are investment products that put money into other funds. These FoFs are specific mutual fund schemes that invest in various other schemes or products.In mutual fund reporting systems, ETF investments via FoFs are categorised as “corporate” AUM rather than retail or HNI investments. This classification occurs because the FoF scheme, operated by a mutual fund, holds the ETF units directly.“The AUM figures primarily reflect corporate investments because retail investors usually access gold through Fund of Funds (FoFs), which in turn invest in Gold ETFs,” said Niranjan Avasthi, senior vice president, Edelweiss AMC.Also Read | India has the world’s 7th highest gold reserves! Why is RBI buying gold and how does it help the Indian economy?Multi-asset funds, which are favoured by investors, also include gold ETF investments in their portfolio. When an Asset Management Company (AMC) lacks its own gold ETF, investments from their gold FoFs or multi-asset funds go into other AMCs’ gold ETFs. These investments appear as corporate AUM in the respective gold ETFs, according to Avasthi.When AMCs without their own gold ETF receive investments for their gold FoFs, they direct these funds into other companies’ gold ETFs. Subsequently, these investments are documented as corporate AUM in those particular gold ETFs, as explained by Avasthi.Individual investors have increased their investments in gold Fund of Funds (FoFs) since July 2024, primarily due to advantageous tax modifications. The government’s budget declaration established that when gold and equity-oriented FoFs are retained beyond 24 months, they would attract a long-term capital gains tax of 12.5%.