Phillip Capital flags growth risks for Dixon Tech amid rising competition; lowers target price to ₹9085

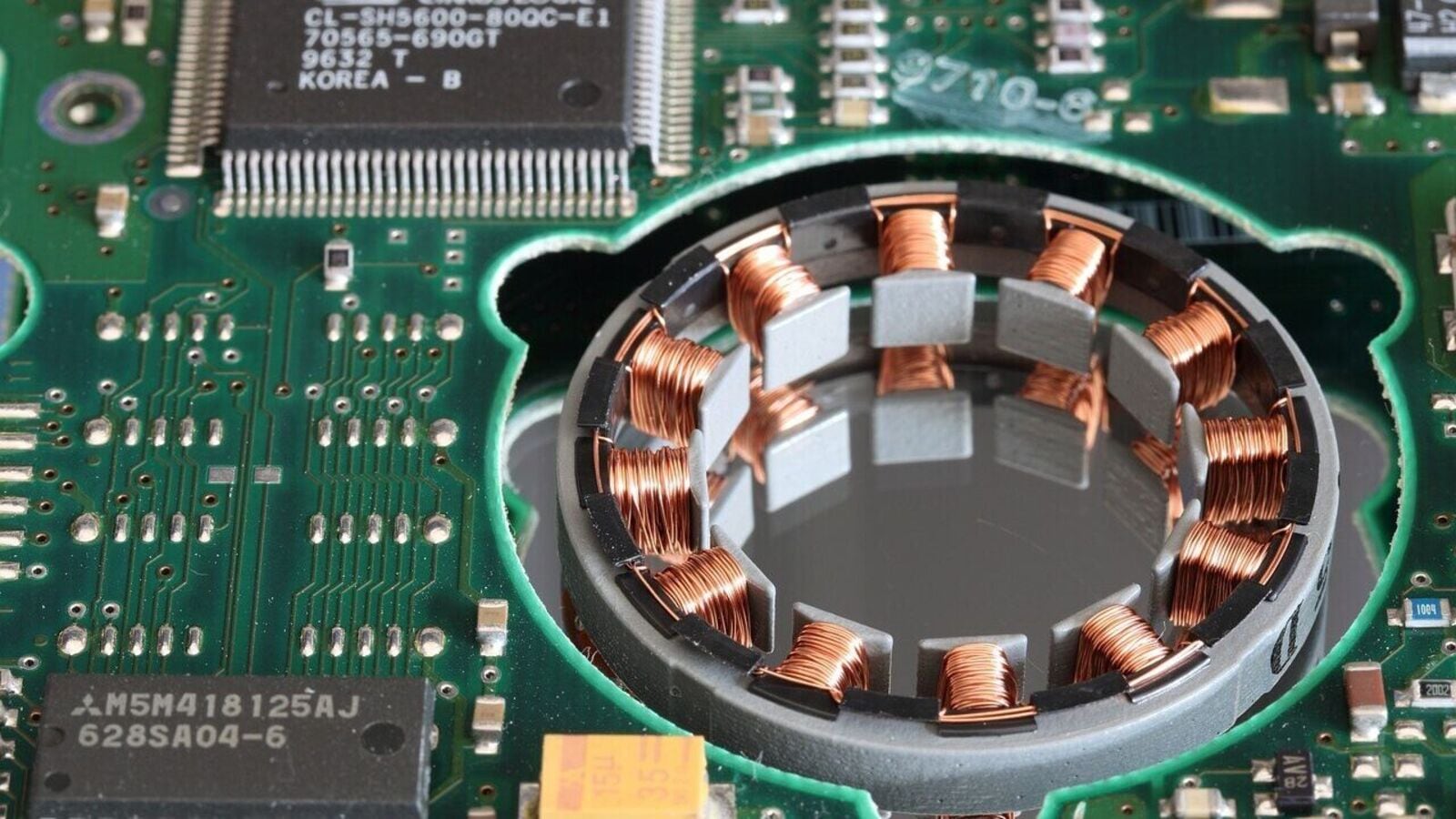

Dixon Technologies share price in focus: Shares of Dixon Technologies tumbled 2.5% in Wednesday’s trade (June 25), falling to ₹14,585 apiece, even as the broader Indian stock market traded in positive territory. This drop in one of the country’s leading EMS (Electronics Manufacturing Services) companies came after global brokerage firm Phillip Capital downgraded its estimates for Dixon, citing rising competition in the mobile phone assembly space.

According to the brokerage, Dixon’s largest client, Motorola, has started outsourcing domestic volumes to Karbonn, which currently accounts for 25% of Motorola’s monthly volume, a figure expected to rise to 35% by June. As part of its diversification strategy, Motorola has been actively expanding its supplier base.

Motorola contributes approximately 40% of Dixon’s mobile phone volumes but nearly 72% of its mobile phone revenues. Dixon had significantly benefited from Motorola’s market share gains in the Indian smartphone market in CY24 compared to CY23.

When Motorola was a smaller player in CY23, Dixon handled its entire manufacturing. As Motorola has achieved scale, it has started outsourcing some of its volumes to Karbonn to diversify its supply chain, said Phillip Capital.

It is worth noting that Karbonn itself is a recipient of mobile phone PLI and, therefore, can be cost-competitive in the mobile phone assembly space. The brokerage noted the company’s exports have ramped up in the last few months, but domestic volume gain by Karbonn means Dixon’s YoY growth from Motorola will be capped at 15% at best.

Longcheer (another Dixon client) has started testing the waters with Karbonn

In addition to Motorola, Dixon’s second-largest client, Longcheer, has also begun diversifying its supply chain. While Dixon’s volumes from Longcheer have grown over the past year, the client outsourced a small portion (2%) to Karbonn in May CY25.

Though currently modest, Phillip Capital believes this could scale up quickly, following a pattern similar to Motorola’s shift. Motorola initially outsourced just 1–2% of its volumes to Karbonn in February CY25, which jumped to 30% by May.

On a more positive note, Dixon and Vivo entered into a 51:49 joint venture (JV) for mobile phone manufacturing in December CY24. The JV, which is currently awaiting regulatory approval, is expected to begin contributing to Dixon’s topline by FY27.

Management anticipates that the JV will handle two-thirds of Vivo India’s mobile phone volumes. Based on a proportional volume-to-value ratio, the JV could generate revenue of ₹160 billion at optimal utilization, with Dixon’s share estimated at ₹80 billion.

Phillip cuts earnings estimate to account for rising competition

Phillip Capital has lowered its revenue, EBITDA, and PAT estimates for Dixon Technologies for FY27 by 4%, 6%, and 9%, respectively, to reflect the intensifying competition in the mobile phone assembly space.

Dixon shares its PLI (Production Linked Incentive) benefits with its mobile phone clients, which is currently offset by favorable Net Working Capital (NWC) terms. However, once the mobile phone PLI scheme ends, the brokerage expects Dixon’s NWC days to trend toward 35+, in line with peers—Foxconn’s stood at 40+ in CY24—which could lead to a declining RoCE trajectory.

Factoring this in, Phillip Capital has also revised its valuation multiple, cutting the PE multiple from 50x to 45x FY27 EPS of ₹202, resulting in a revised target price of ₹9,085, down from the earlier target of ₹11,077.

Disclaimer: This story is for educational purposes only. The views and recommendations above are those of individual analysts or broking companies, not Mint. We advise investors to check with certified experts before making any investment decisions, as market conditions can change rapidly, and circumstances may vary.