Four Indian companies walking a fine line

Several marquee Indian companies are now testing that fine line between smart expansion and costly distraction. Grasim’s recent move into paints, UltraTech’s foray into cables and wires, and IndiGo’s venture into hotels have raised eyebrows. But in each case, there’s a strategic logic: Grasim and UltraTech can leverage their existing cement distribution networks, while IndiGo’s established travel brand can extend naturally into hospitality.

Others, however, have ventured into businesses far afield from their core competencies—often with damaging results.

Read this | Company Outsider: The Gensol-BluSmart fiasco shows the dangers of reckless diversification

Here are four listed Indian companies that show how overextension can strain even established businesses.

Unitech: Diversification derailed the core

By the early 2000s, Unitech had cemented its position among India’s top real estate developers, with residential complexes, commercial projects, and amusement parks sprawled across more than 14,500 acres.

Following India’s 2005 liberalization of foreign investment in real estate, Unitech drew substantial foreign interest and saw its stock soar by 3000% in a year.

Flush with cash, the company ventured into telecom in 2007. But the global financial crisis hit its real estate business hard, and the telecom bet proved disastrous. The venture saddled Unitech with crippling debt. The 2G spectrum scandal that followed led to cancelled licences, criminal charges against its promoters, and the forced sale of its telecom operations. At its peak, the company owed ₹8,000 crore in debt.

The collapse spilled into its core real estate business: stalled projects, mounting client complaints, regulatory interventions, and severe brand erosion. Though Unitech has since pivoted back to real estate, it faces a long road to recovery from the debt burden, reputational damage, and years lost chasing an ill-fated diversification.

OK Play India: Stretching to thin

OK Play began as a manufacturer of water tanks, but over time expanded into a disparate set of businesses: toys, auto components, delivery boxes, mannequins, and electric three-wheelers. Management has cited plastic as the common thread—but the reality has been less convincing.

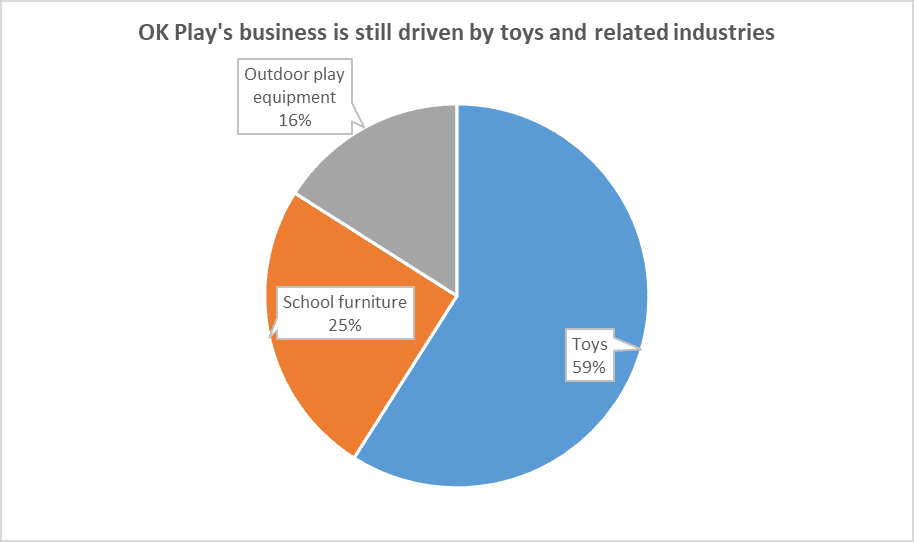

The company struggled to leverage any synergies between these businesses, failing to transfer brand strength, manufacturing capabilities, or distribution scale across segments. Its core toy business continues to drive most of its revenues, while newer ventures have mostly added losses and distraction.

Despite management’s stated goal of doubling toy revenues annually and targeting 15-20% growth in other segments, its history of losses casts doubt on such projections. Recent expansions into home décor and air purifiers only raise further concerns. For OK Play, focus on profitable segments rather than new distractions appears critical.

Patanjali Foods: Early signs of overreach

Investor favourite Patanjali Foods, once an edible oil company, has successfully transformed into a broader FMCG player by acquiring foods and home & personal care businesses from its parent. Today, it ranks as India’s third-largest FMCG company by revenue.

However, while it has climbed the revenue ranks, profitability remains a weak spot. Revenues have also been vulnerable to volatile edible oil prices. The growing contribution of higher-margin segments has eased some of those concerns, and after several years of underperformance, the stock has been outperforming since June 2023.

But recent moves have raised concerns that Patanjali may be drifting into “diworsification.” Its investment in wind power generation has already resulted in intermittent losses. Even if that can be justified as captive green energy for its core operations, its more recent forays into construction and infrastructure with KBC Global, and insurance with Magma General Insurance, mark clear departures from its core strengths. How management navigates these ventures remains to be seen.

Balmer Lawrie: Overdiversification hits PSUs too

Established in the pre-independence era, Balmer Lawrie is now a central PSU under the Ministry of Petroleum and Natural Gas, classified as a Miniratna-I company. As the company itself puts it, there is scarcely a business it hasn’t ventured into.

It has ventured into tea, shipping, insurance, banking, and manufacturing over the years. Today, it operates across eight strategic businesses spanning manufacturing and services. Its manufacturing portfolio includes industrial packaging, greases and lubricants, and chemicals, alongside refinery and oil field services. While some of these businesses are adjacent, the company’s sprawling portfolio suggests an overextension of its operating focus.

Read this | How ITC and BAT’s divergent diversification strategies flipped the narrative

In its travel vertical, Balmer Lawrie offers services ranging from travel planning, ticketing, forex, and hotel bookings to visa processing and travel insurance. It also runs logistics operations, including cold chain logistics and door-to-door freight forwarding.

While logistics contributes a fifth of the company’s revenues, its subsidiary, Visakhapatnam Port Logistics Park, has been a drag on profitability. The travel vertical has limited revenue contribution, with a bulk of the business still being driven by industrial packaging, and greases and lubricants. Result? Distractions from multiple fronts have kept profits volatile.

When diversification Becomes diworsification

Diversification isn’t inherently negative. Expanding into upstream or downstream segments can lower costs, while entering adjacent businesses can help de-risk operations and cushion against business-cycle or seasonal fluctuations.

Also read | Why some Indian companies are paying dividends despite posting losses

The real concern arises when companies venture into industries entirely unrelated to their core strengths. Done well, such moves can mark the early stages of building a diversified conglomerate—as seen with Reliance Industries Ltd or ITC Ltd. But execution is critical, and professionally managed firms are better equipped to navigate the risks. Even then, conglomerates often trade at a discount, with the whole valued less than the sum of their parts.

If a company has proven its strength in its core business, investors may be willing to back unrelated diversification—Patanjali Foods being one example. But when companies already struggling at the core venture into unrelated businesses, they risk spreading themselves too thin. Bull markets may temporarily lift such stocks on a wave of optimism, but when sentiment cools and fundamentals reassert themselves, these weaknesses are quickly exposed.

For more such analyses, read Profit Pulse.

Ananya Roy is the founder of Credibull Capital, a Sebi-registered investment adviser. X: @ananyaroycfa

Disclosure: The author does not hold shares of the companies discussed. The views expressed are for informational purposes only and should not be considered investment advice. Readers are encouraged to conduct their own research and consult a financial professional before making any investment decisions.