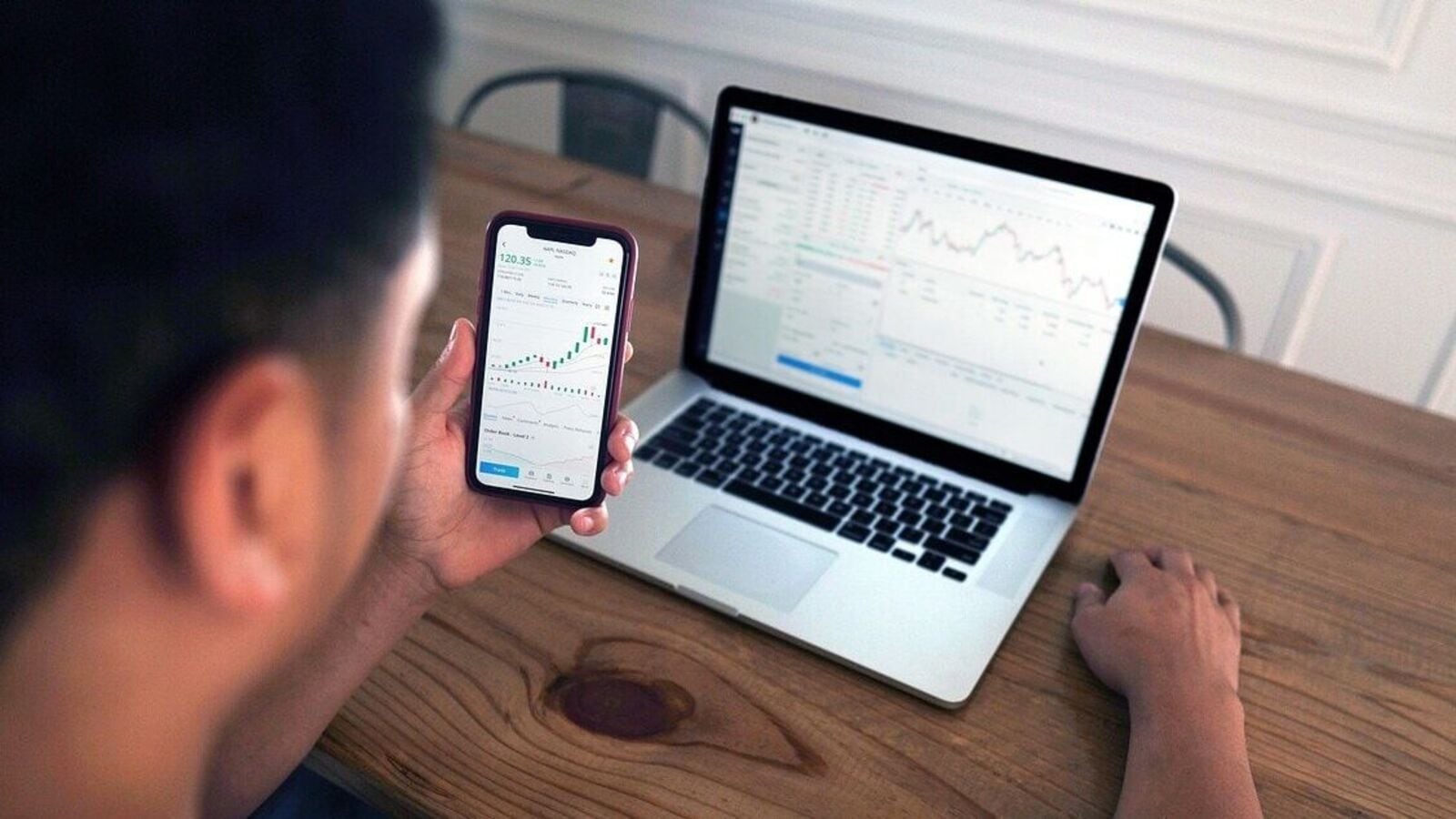

Mint Primer | Shades of grey: Inside the world of pre-IPO trading

[ad_1]

The grey market in equity trading is in the limelight after retail investors were taken to the cleaners during the mega ₹12,500-crore initial public offering (IPO) of HDB Financial Services—among the most sought-after. Mint takes a look at this dark corner of Dalal Street.

What is the grey market in equities?

It’s the unofficial market where stocks are bought and sold before they complete the IPO process and are officially listed on exchanges. This market is not regulated by any official body like the Securities and Exchange Board of India (Sebi), and business is done without the involvement of recognized stock exchanges like the NSE or BSE. There is no digital bookkeeping. Transactions are conducted in cash, often with dealers exchanging small slips of paper. Some websites and online forums allow investors to trade in the grey market, though the primary functioning remains via word of mouth and mutual trust.

What is grey market premium (GMP)?

GMP refers to the difference between the issue price of an IPO and the price at which the shares are being traded in the grey market. A high GMP means investors are willing to pay a premium for the shares, reflecting optimism about the firm (or the listing). The GMP has emerged as among the most keenly tracked metrics for assessing IPOs, but this should not be taken as gospel truth. HDB Financial shares were changing hands for ₹1,225 and above in the grey market. However, the firm later set the upper end of the price band at ₹740—resulting in a 40% plunge in the GMP, jolting investors.

What are the types of trading in this market?

In share-based deals, a seller agrees to sell shares allotted to them at an agreed price. Application-based deals are of two types. First, ‘kostak rate’—the amount a grey market participant pays to someone selling his IPO application. The applicant gets the money irrespective of whether he gets the shares. Second, ‘subject to sauda’: payout occurs only if the seller is allotted shares.

Do such markets exist only in India?

No. Pre-IPO shares are traded in many markets, including Wall Street, but the process is more streamlined. In many cases, only accredited investors can deal in unlisted shares. In the US, retail investors can use a number of dedicated online platforms to buy and sell unlisted shares. Major brokers also provide access to pre-IPO shares to high-value clients. Sometimes there is a minimum investment criteria. There are also some exchange-traded funds (ETFs) which invest in privately held companies.

How should Indians approach this market?

Most experts recommend retail investors steer clear of the grey market due to the risks. The short supply of pre-IPO shares, which are held by a small group of insiders, makes the market extremely illiquid, which means prices can swing wildly—an impediment to valuing a company reasonably. The GMP of an issue should not be the sole criteria for deciding whether to apply for an IPO. However, when paired with other sources of credible information, it can aid investors’ decision-making process.

[ad_2]

Source link