Debt-free stocks aren’t always risk-free. Here’s proof.

And rightly so: a clean balance sheet often signals financial strength. Companies with zero debt enjoy lower interest burdens, greater flexibility, and resilience during downturns. But here’s the catch—being debt-free doesn’t make a stock risk-free.

A company may have no leverage, yet still struggle with low margins, poor execution, policy shocks, governance issues, or rising competition. In some cases, staying debt-free isn’t even a choice—lenders might avoid the business altogether. That’s why investors need to look beyond balance sheets and ask: is a debt-free company fundamentally sound, or are there hidden risks?

This article examines three such stocks—Mazagon Dock, Indraprastha Gas, and Sirca Paints—which appear strong on paper but face serious headwinds.

Mazagon Dock: Defence tailwinds aren’t bulletproof

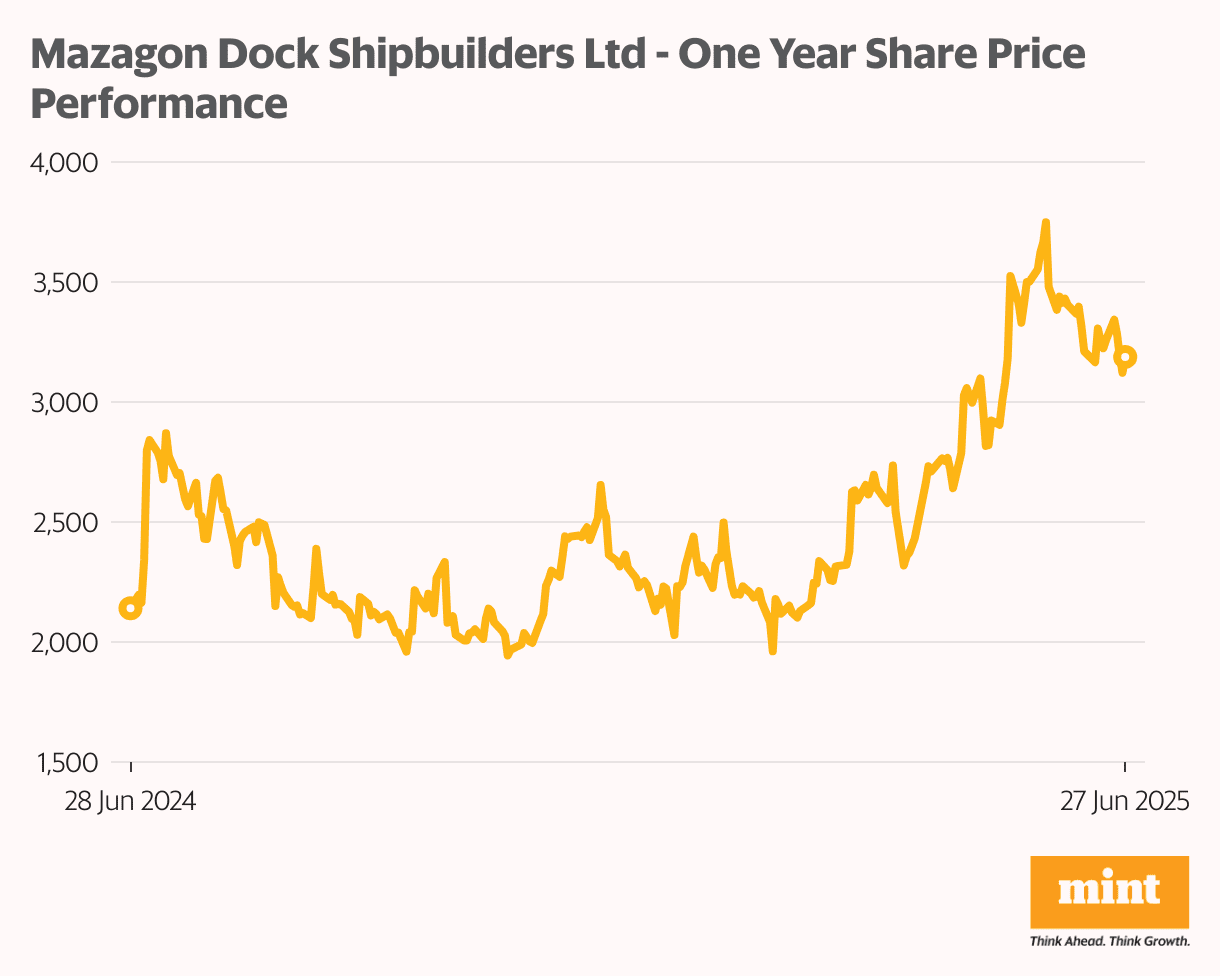

Mazagon Dock Shipbuilders Ltd has been a star of India’s booming defence manufacturing push, delivering a staggering 3,600% return over the past five years.

Founded in 1774, it’s the only Indian shipyard to have built destroyers, submarines, and corvettes for the Indian Navy. It has remained debt-free since FY16—alongside peers like Garden Reach (also debt-free) and Cochin Shipyard (which carries minimal debt of ₹23 crore).

But its customer concentration poses a key risk. Nearly all of Mazagon’s revenue depends on the Ministry of Defence (Indian Navy), making it highly vulnerable to budget cycles, policy changes, and procurement delays that could impact order flows.

Shipbuilding is a long-gestation industry, with large vessels taking four to six years to complete. Revenues are booked on a percentage-of-completion basis, making earnings vulnerable to project delays.

This risk played out in Q4FY25. Despite a strong order book, revenue grew just 2.3% YoY to ₹3,174 crore. Margins, however, collapsed by 14 percentage points to 3%, dragging net profit down 51% to ₹327 crore.

A sharp rise in expenses was to blame. The company made provisions of ₹532 crore—up 460% YoY—for potential losses on two contracts: a Fast Patrol Vessel for the Coast Guard and six ships for Denmark. The spike reflects component cost escalations and margin compression from rising subcontracting costs.

The margin blowout wasn’t just a one-off. Management has warned that recently completed high-margin contracts aren’t sustainable going forward.

While the current order book of ₹32,260 crore provides revenue visibility for three years, growth momentum is softening. The company now expects revenue growth of 8–10%, less than half its recent pace. Large projects like Project 75(I) are facing delays.

Mazagon hopes to win ₹90,000 crore in new orders, which would boost its total order book to ₹1.25 trillion. But it expects profit-before-tax margins to fall to 15%, down from 25-26% in the recent past.

The acquisition of Colombo Dockyard adds further risk. While it could boost revenue by 25%, the Sri Lankan firm reported a ₹90 crore loss on ₹725 crore revenue in FY24 and carries ₹1,091 crore in debt. The acquisition ends Mazagon’s debt-free status and puts near-term pressure on margins.

Read this | Mazagon Dock investors should not get swayed by narrative and newsflow

At a P/E of 52, the stock’s valuation leaves little room for disappointment, especially with growth slowing and profitability under strain.

Indraprastha Gas: Caught between gas cuts and EV adoption

Indraprastha Gas Ltd (IGL), another debt-free name, is facing risks on multiple fronts.

The most immediate concern is regulatory. City gas distributors like IGL depend on subsidized domestic gas—allocated by the government—for their core sectors: CNG (transport) and PNG (households). Industrial and commercial demand, however, is met through costlier imported gas.

In November 2024, the government cut domestic gas allocations by 20%—the second such cut in a year. Domestic APM gas production is declining 9–10% annually as fields mature. JPMorgan expects the subsidized allocation to be phased out. To fill the gap, IGL must increasingly rely on New Well Gas (at $8–9/MMBtu) and spot LNG (up to $14/MMBtu).

Read this | IGL seeks renewable energy assets as it looks to turn net zero

The impact is already visible: IGL shares fell 20% on 18 November after the allocation cut. Care Ratings estimates margin erosion of around five percentage points in FY26.

The rise of electric vehicles adds a structural headwind. Delhi, IGL’s core market, is a leader in EV adoption. With 75% of IGL’s CNG revenue coming from Delhi, a long-term decline in demand is likely.

Financially, IGL’s revenue has stagnated at around ₹14,000 crore over three years – ₹14,133 crore (FY23), ₹14,000 crore (FY24), and ₹14,928 crore (FY25). Net profit in the same period has fluctuated: ₹1,640 crore, ₹1,983 crore, and ₹1,713 crore, respectively.

The stock trades at a P/E of 17, well below its 10-year median of 26, reflecting the market’s muted expectations. Like its peers Mahanagar Gas and Gujarat Gas—both debt-free—IGL’s clean balance sheet does not immunize it from regulatory and demand shocks.

Sirca Paints: Clean balance sheet, but cracks are emerging

Sirca Paints, known for its premium wood finishes under the Sirca and Unico brands, has grown steadily but faces rising competitive pressure.

The company earns about 70% of revenue from retail customers and 30% from OEMs like Godrej and Jindal Stainless. Revenue rose from ₹264 crore in FY23 to ₹374 crore in FY25, but profit remained largely flat – ₹46 crore, ₹51 crore, and ₹49 crore over FY23–25.

Sirca’s margins declined by 89 basis points to 18.8% as new entrant Birla Opus captured 6.1% market share, mainly from larger players like Asian Paints and Berger. With a modest 0.6% share, Sirca is especially vulnerable. To defend its turf, it may need to increase discounts, putting further pressure on margins.

Input costs are another concern. Crude oil derivatives account for 40% of Sirca’s raw material expenses, exposing it to volatility in global oil prices.

Despite these challenges, Sirca remains entirely debt-free, unlike larger rivals such as Asian Paints ( ₹864 crore), Berger Paints ( ₹146 crore), and Kansai Nerolac ( ₹118 crore). But in a consolidating market, Sirca may face pressure to scale up, possibly making it an acquisition target.

Conclusion: Debt free is not risk free

A debt-free balance sheet may provide comfort, but it doesn’t tell the full story.

Mazagon Dock’s stretched valuation and falling margins highlight how execution risks and order dependency can undermine even a high-performing stock. Indraprastha Gas faces regulatory cuts and long-term demand shifts as EVs gain ground. Sirca Paints, while financially conservative, is up against intensifying competition and volatile input costs.

Each of these companies shows that low or no leverage doesn’t shield against growth headwinds, margin pressure, or strategic threats.

For more such analyses, read Profit Pulse.

Ultimately, earnings growth and business quality matter more than balance sheet optics. Investors must dig deeper to ask: is the company truly debt-free—or just waiting for its next challenge?

About the author: Madhvendra has over seven years of experience in equity markets and has cleared the NISM-Series-XV: Research Analyst Certification Examination. He specialises in writing detailed research articles on listed Indian companies, sectoral trends, and macroeconomic developments.

Disclosure: The writer does not hold the stocks discussed in this article.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.