Bulls take the wheel as Nifty eyes lifetime high after breaking free

Mumbai: The Nifty 50 appears firmly on track to challenge its record high from last September after breaking out on Thursday from a one-and-a-half-month range-bound activity. Supported by bullish rollover signals from the June derivatives expiry, the index has turned former resistance into fresh support, even as foreign investors continue to pare equity holdings while domestic institutions keep pouring in funds.

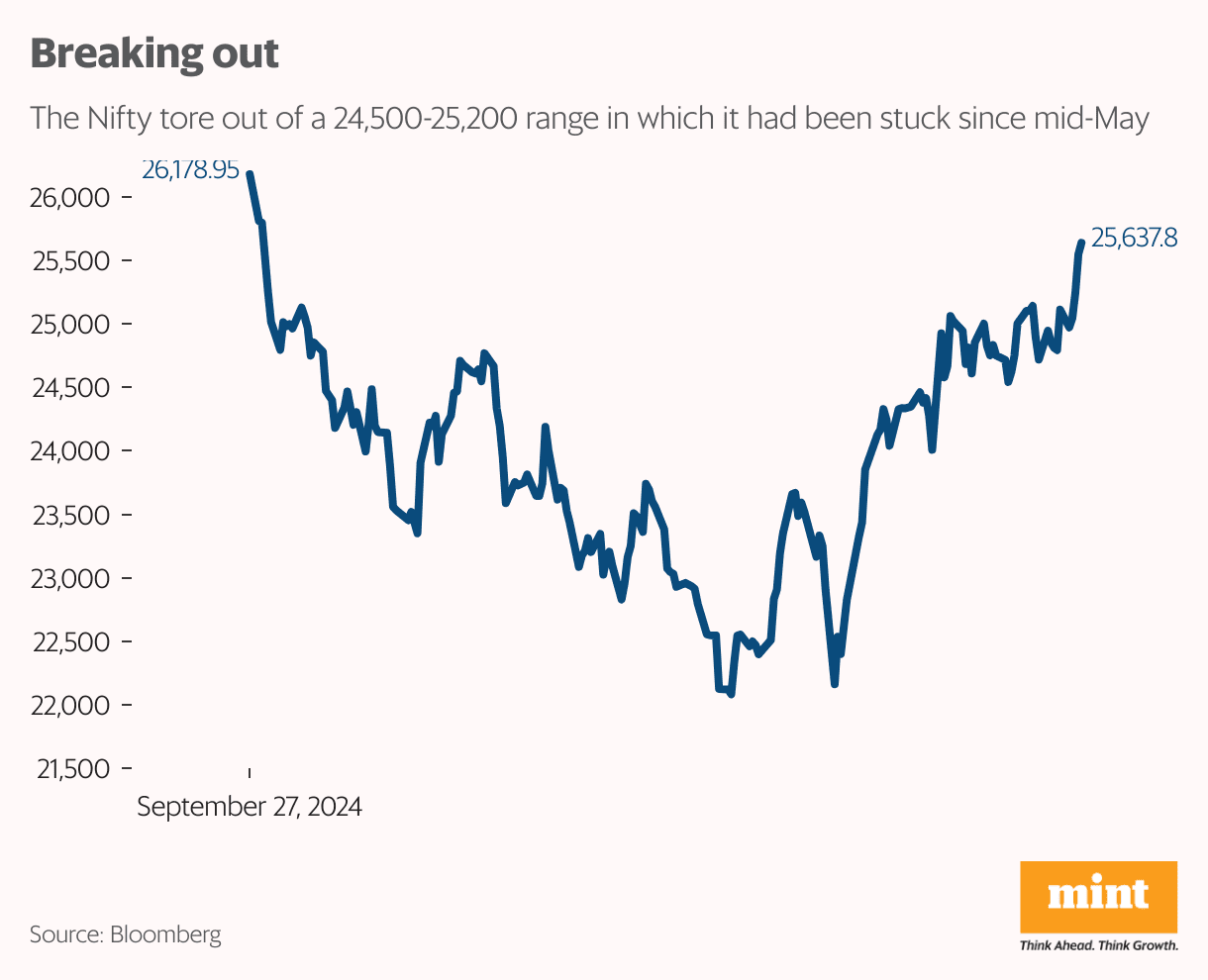

On Thursday, the bellwether index rose 1.2% to 25,549 on the expiry of the June series of derivatives, decisively breaching the 24,500-25,200 range that it had been stuck in since mid-May. Marketwide futures and options contracts expire on the last Thursday of every month.

The Nifty 50 consolidated its gains further on Friday to close up 0.35% at 25,637.8, placing it just 2.5% away from its record high of 26,277.35 on 27 September last year.

Rival benchmark BSE Sensex mirrored the trend, rising 1.2% to 83,755.57 on Thursday, and another two-fifths of a percent to 84,058.9 on Friday, ending just 2.28% shy of its record high of 85,978.25 on 27 September.

The rollover data, which pertains to the NSE derivatives, showed that 80% of Nifty futures contracts were carried forward to the July series, up from the three-month average of 78%, per data from IIFL Capital Services.

“After close to one and half months of consolidation, Nifty is breaking out of an expanding triangle (bullish continuation pattern). We believe this opens space for the index to move towards its previous highs (26,200 levels),” read the IIFL Capital Services rollover report, further noting that the previous resistance of 25,200 had now become a strong support.

This indicates an up-trending market, according to Kruti Shah, quant analyst at Equirus Securities. “The Nifty has set its sights on its all-time highs with the decisive breaking of the 25,200 resistance,” Shah said.

The Nifty is expected to veer between a support and resistance of 25,380 and 25,920 next week, per options data. The bias for now is toward the upper end of the range, added Shah.

The market rally has been driven by domestic inflows, especially from mutual funds, pension and insurance funds, even as foreign investors have remained net sellers.

While foreign portfolio investors (FPIs) sold shares worth $10.7 billion from January 2025 through 20 June, domestic institutional investors or DIIs pumped in almost $40 billion over the same period, per Nitin Jain, CEO & CIO of Kotak Mahindra Asset Management (Singapore).

Interestingly, while mutual funds accounted for 68% of the DII net inflows at $27 billion, the share of other domestic institutions like insurance and pension funds stood at $13 billion, which is higher than the $11 billion they invested in the whole of calendar year 2024.